Calculating payroll deductions worksheet

To enter your time card times for a payroll related calculation use this time card calculator. Gross Pay or Salary.

Payroll Calculator With Pay Stubs For Excel

Get the best template from a variety of formats available like PDF PSD.

. Occupation and industry specific income and work-related expenses. D Pre rules deductions. Sometimes calculating payroll is as easy as only determining the amount of taxes to withhold.

Before sharing sensitive information make sure youre on a federal government site. National rental affordability scheme. Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3.

Records you need to keep. How to use an employee payroll spreadsheet template. But instead of integrating that into a general.

Federal government websites often end in gov or mil. Typically an employees disposable income is used to determine the limits of child support deductions. For example say you need to pay for utilities for the.

This credit is figured like last years economic impact payment EIP 3 except eligibility and the amount of the credit are based on your tax year 2021 information. You will receive a withholding notice if you are required to make child support deductions from an employees wages. They refer to the amount of money taken out of your paycheck during the year.

See the instructions for Form 1040 line 30 and the Recovery Rebate Credit Worksheet. Business income insurance can help cover these payroll costs. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

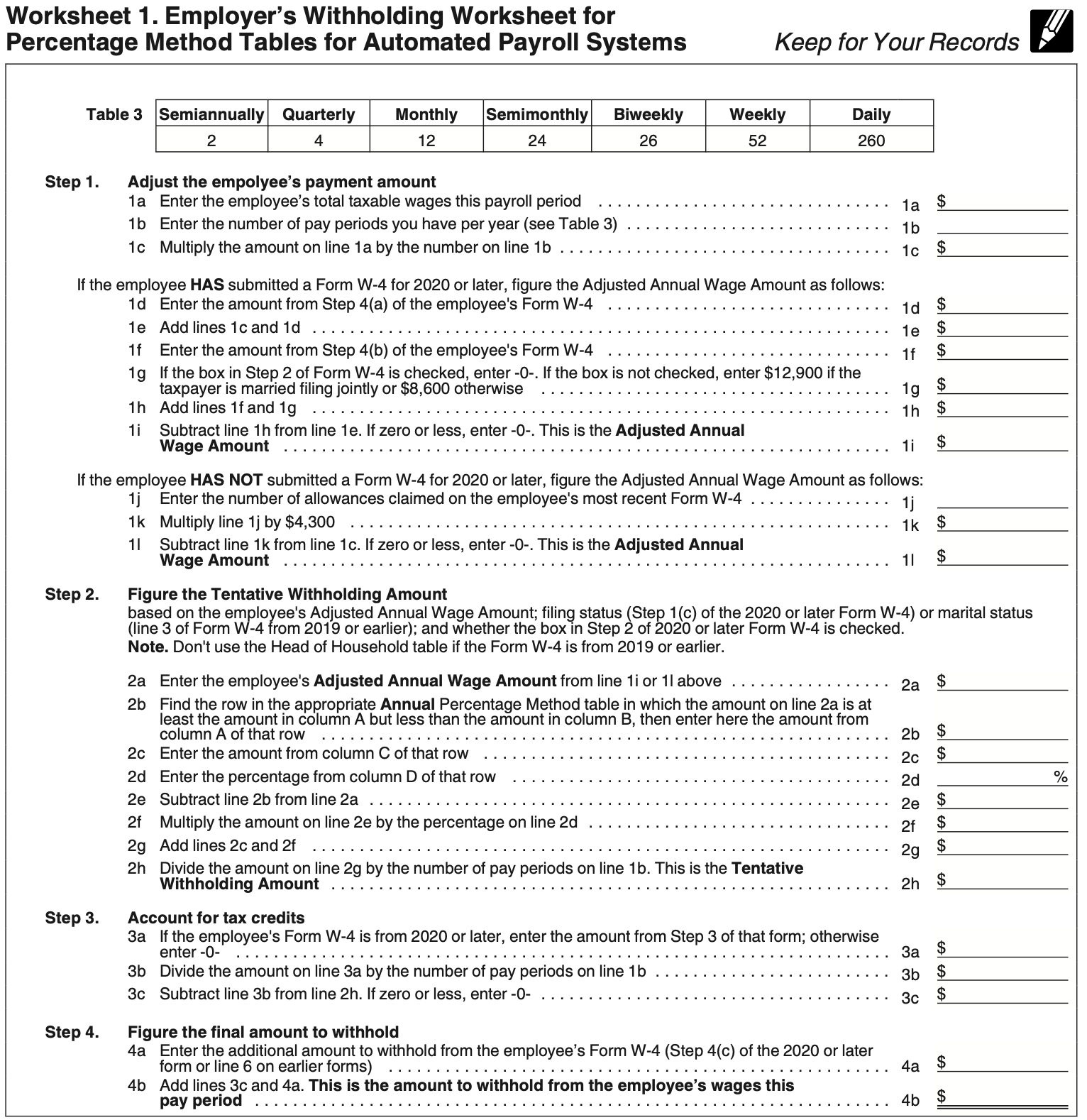

The employees deductions are on the 1040EZ form. Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employees paycheck. There are two types of deductions to consider when calculating payroll.

Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2019 OR 2. F Prospective rules deductions. Many a time the paystub will also have employer only payments like FUTA and SUTA.

Other times you have employee deductions to calculate too. This includes income taxes Social Security and Medicare taxes. Generally a payroll spreadsheet template includes ways to track employee information schedule organization calculating payroll costs and generate earning statements.

T2 T4 V1 S LCP If the result is negative T2 0. For example say you have five employees that need to get paid while your operation is temporarily shut down. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR.

Calculating Employee Payroll Taxes in 5 Steps. Quebec employers whose employees receive income from tips and gratuities should review the section called Calculating payroll deductions for employees in the hotel and restaurant business in Quebec in the publication T4032QC Payroll Deductions Tables. Consolidation deductions relating to rights to future income consumable stores and work in progress.

If you can exceed these numbers you may be able to itemize list and add up your deductions and therefore pay less in taxes. Income deductions offsets and records. Child support withholding is a court-mandated payroll deduction.

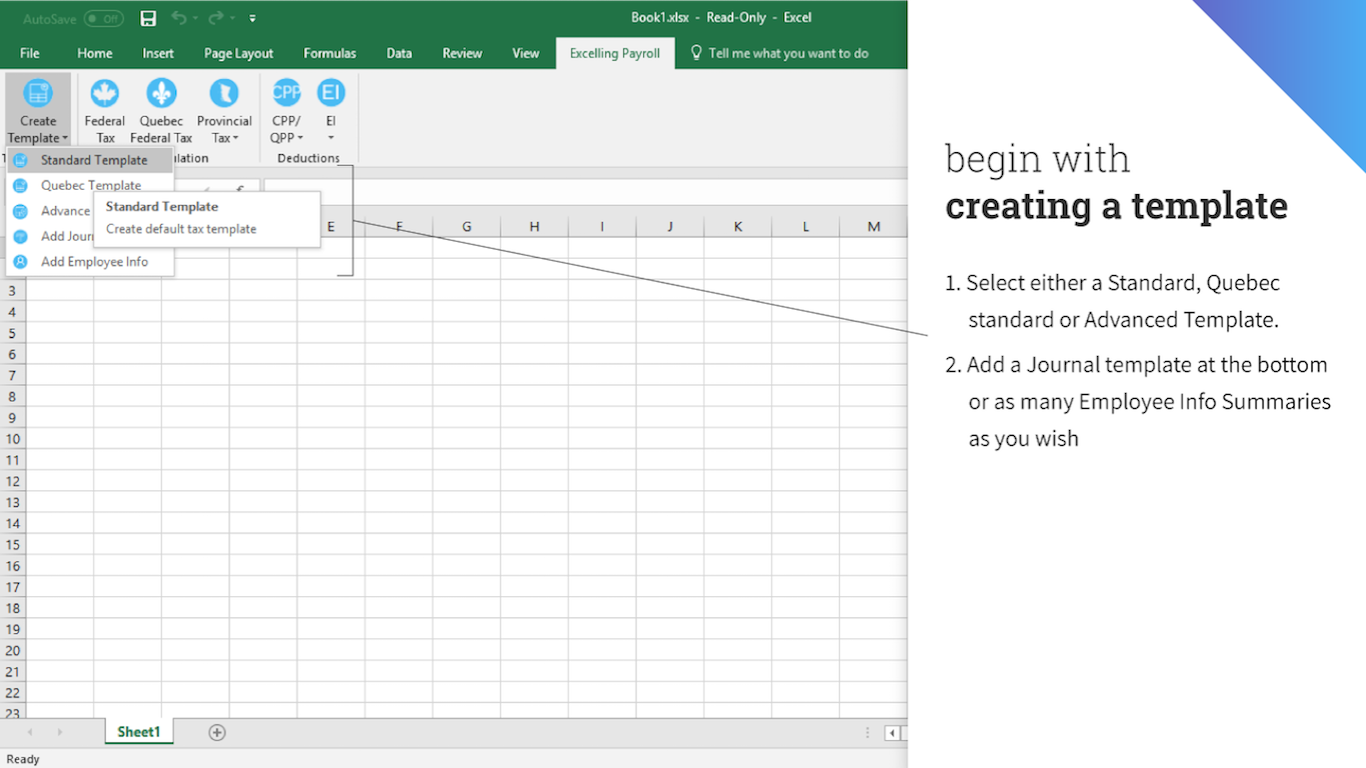

You should create tabs for every month that you link with formulas to calculate and total your employees deductions pay and taxes. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Once your employees are set up and your business is set up too youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheldAnd if necessary making deductions for things like health insurance retirement benefits or garnishments as well as adding back expense.

Get the latest financial news headlines and analysis from CBS MoneyWatch. Pre-tax deductions are what they sound like. You simply multiply QBI 60000 by 20 to figure your deduction 12000.

Calculating your payroll taxes is the hard partactually making the payments is easy. Heres an example. In addition you also must have a setup tab where your payroll calculations can pull basic information.

Determine your itemized deductions. If you have other sources of retirement income such as a 401k or a part-time job then you should expect to pay some income taxes on your Social Security benefits. Payroll management requires a set of processes to be followed which starts with calculating the basic pay and ends with offsetting all deductions to get the gross pay.

J National rental affordability scheme tax offset entitlement. The payroll checklist template helps the management to ensure the work has been performed accordingly. You just enroll in the Electronic Federal Tax Payment System EFTPS then make your payment online.

You will need your prior years annual tax return in order to fill out Form 1040-ES. Residential rental properties and holiday homes. Allowances and exceptions are the same.

Accessing your income statement. Single people are allowed a 12000 standard deduction and married couples filing jointly are allowed a 24000 standard for 2018. A proper paystub will have all the earnings broken down as regular earnings holiday pay overtime etc.

The gov means its official. The first step to filling out an excel payroll worksheet template is assembling all pertinent data. How to make payroll tax payments.

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level. Working from home expenses. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

Part of processing your own payroll is calculating the payroll taxes that you have to withhold from employee paychecks. This tab asks for information like an employees. Deductions you can claim.

Income you must declare. The taxes and deductions include Federal and State Withholdings FICA Social Security and Medicare Health Insurance and other benefit deductions. You can efficiently do payroll with Excel by using a standard payroll template to use each month.

Enter employee details under the employee information tab on the bottom left of the worksheet. Use the worksheet found in Form 1040-ES Estimated Tax for Individuals to find out if you are. The most vital part of processing payroll is identifying each employees allowances and deductions.

In practice in the United States employees use Internal Revenue. You can access EFTPS here. Its the only way to make a payroll tax payment mailing checks isnt allowed.

Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. W-4 forms help to determine wages. If you rely exclusively on.

The deduction comes out of the. Your taxable income is 150000 of which 60000 is QBI. E Interim rules deductions.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Solved W2 Box 1 Not Calculating Correctly

Enerpize The Ultimate Cheat Sheet On Payroll

Mathematics For Work And Everyday Life

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Find The Right App Microsoft Appsource

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Mathematics For Work And Everyday Life

Quiz Worksheet Calculating Payroll Costs Study Com